KEY HIGHLIGHTS

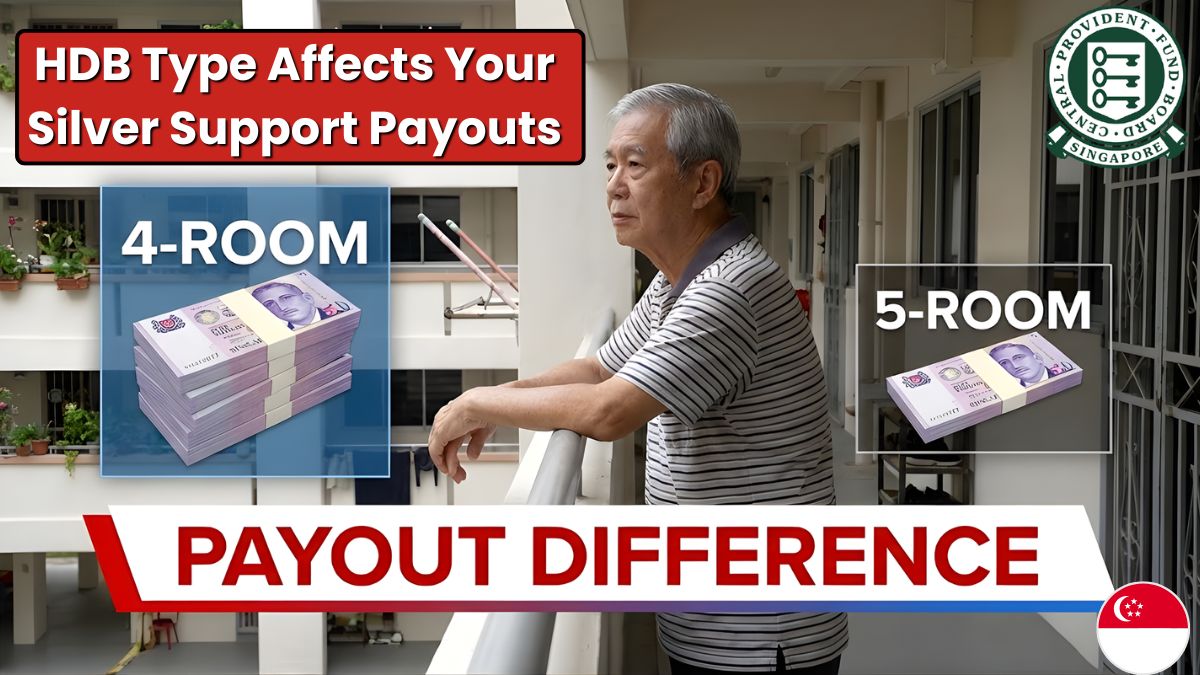

- Silver Support payouts in 2025 vary based on your HDB flat type.

- Seniors in 4-room flats get about double what 5-room residents receive.

- Larger flats lead to lower payouts as you’re expected to have more assets.

HDB Type Affects Your Silver Support Payouts: Many seniors—from Jurong East to Pasir Ris—often wonder why two neighbours of the same age can receive very different Silver Support payouts. You hear this all the time at the kopitiam: “Eh, why he get more than me?”

And the truth is quite simple: your HDB flat type plays a big role.

The Silver Support Scheme (SSS) gives quarterly cash support to seniors aged 65 and above who had lower incomes during their working years. But because income records alone don’t always show your real financial situation, the government uses housing type as a proxy to assess how much help you might actually need.

Quick Comparison: 4-Room vs 5-Room Silver Support Payouts (2025)

Before we dive into the details, here’s a clean breakdown of how the two common flat types stack up for 2025.

| HDB Flat Type | Estimated Quarterly Payout (2025) | Support Tier | Why the Difference |

|---|---|---|---|

| 4-Room | $480 – $530 | Medium Tier | Considered moderate asset level |

| 5-Room / Executive | $240 – $265 | Lowest Tier | Assumed ability to monetise or right-size |

Check Here Your Silver Support payouts Eligibility

Why Housing Type Matters for Silver Support

The scheme follows a simple principle:

Smaller flat → fewer assets → higher support.

If you’re living in a 1-room or 2-room flat, the system assumes that you’re more likely to need stronger financial help. These seniors typically fall into the highest benefit tier, receiving payouts that can cross $900+ per quarter in 2025 (subject to official revisions).

Once you move into the mid-sized or larger flats, the support starts dropping—sometimes sharply.

4-Room HDB: The “Middle” Tier of Support

Most Singaporeans own 4-room flats, so this is where we see the most questions.

Seniors living in 4-room flats usually receive a medium level of Silver Support.

For 2025, the estimated quarterly payout is around $480 to $530.

Why this amount?

Because the government’s view is that you likely have moderate stability—not as few assets as someone in a 1-room flat, but not as much financial buffer as someone in a 5-room home.

If you’re still watching your budget closely—hawker prices going up, utilities creeping higher—this amount can still make a difference.

5-Room or Executive Flat: The Lowest Tier of Support

Here’s the part many seniors find surprising.

If you live in a 5-room flat, your quarterly payout drops significantly to roughly $240 to $265.

The assumption here is straightforward:

A larger home usually means higher asset value, which means you may have the option to:

- Rent out a room,

- Right-size to a smaller flat, or

- Tap on property value if needed.

It isn’t always realistic for every senior, of course—many of us want to grow old in the same home we’ve lived in for decades. But the payout formula still works this way.

Important Property Ownership Rules (Many People Forget These)

Flat type isn’t the only thing that matters.

Your overall property ownership can disqualify you completely.

1. You cannot own private property

If you or your spouse owns any private property—condo, landed, overseas property—you’re not eligible.

2. You cannot own more than one property

This includes shophouses, second flats, and mixed-use units.

Even if the second property isn’t earning money, you’re still considered ineligible.

3. Household income matters

Even if you stay in a 4-room flat, your household income per person must fall within the official 2025 limits (usually in the $1,800–$2,300 range).

Exceed it, and you’re out.

What This Means for Seniors Planning Ahead

If you’re thinking of upgrading or helping your children take over a bigger flat, remember this:

A larger home can reduce your Silver Support benefits.

The scheme runs automatically—no application needed—but your eligibility is reviewed yearly.

That means any change in your housing status can affect your next payout.

For some seniors, staying in a smaller home might mean a stronger financial cushion through the scheme.

We’ve put all the key Singapore government payouts for 2025–2026 on one page – GST Voucher, Assurance Package, Silver Support, and SG60 Vouchers.

Check payouts & eligibility overviewFAQs

1. Do I need to apply for Silver Support?

No. If you qualify, the payout is automatic and credited to your bank account.

2. Will selling my flat affect future payouts?

Yes. Your housing status is reviewed every year. If you move to a larger unit, your payout may drop.

3. Can two people in the same flat get different payout amounts?

Yes. Eligibility also depends on individual lifetime income, not just the flat type.

4. What if I’m renting a flat and don’t own property?

Renters are assessed separately. If you meet all other criteria, you may qualify for the higher tiers.

5. Where can I check my Silver Support eligibility?

You can log in to Singpass and view your CPF statements or look out for CPF Board letters sent before each payout cycle.

Final Note

If you’re planning your finances for 2025, keep in mind that your HDB flat type directly influences your Silver Support payouts. A change in housing may mean a change in your cash support.

To get the most accurate figures, always check your Singpass alerts or the official CPF website, as 2025 numbers may shift with budget announcements.