KEY TAKEAWAYS

- Some Social Security “strategies” sound great but don’t fit real middle-class budgets.

- Waiting until 70 can boost benefits, but most Americans can’t delay that long.

- The bottom line: a practical plan beats unrealistic retirement advice.

Let’s be honest — plenty of Social Security advice looks great on paper, but real life doesn’t always cooperate. Middle-class retirees often face tighter budgets, rising costs, and health concerns that make certain strategies tough to follow.

Before we dig into which tips fall short in the real world, here’s a quick comparison to get your bearings:

Social Security Strategy Snapshot (Who Can Actually Use What?)

| Strategy | Why Experts Recommend It | Why It’s Tough for Middle-Class Retirees | Realistic Alternative |

|---|---|---|---|

| Wait until 70 | Boosts monthly check to 124% of FRA benefit | Most households can’t cover bills without earlier income | Delay a year or two instead of waiting until 70 |

| Wait until FRA | Avoids early-claim reduction | Costs keep rising; many need income at 62 | Claim early but plan around reduced benefits |

| Save separate retirement funds | Adds a safety net | High living costs leave little room to save | Small automatic contributions when possible |

| Work part-time in retirement | Helps cover gaps | Health issues, low-paying jobs, age bias | Occasional gig work if manageable |

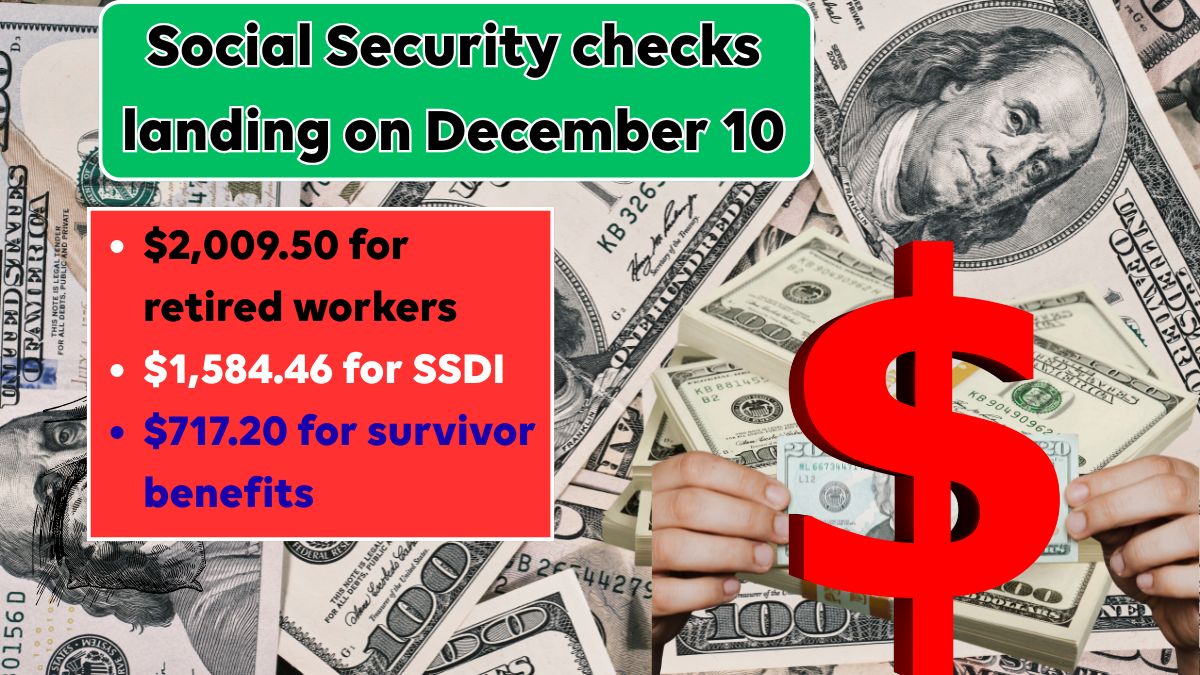

Why Waiting Until 70 Doesn’t Work for Most Americans

Sure, delaying Social Security until age 70 gives you the biggest bang for your buck.

The Social Security Administration boosts your monthly payout every month you delay past your full retirement age.

If you make it all the way to 70, your check jumps to 124% of your FRA benefit.

Sounds great, right?

Here’s the snag — most people can’t wait that long.

A Schroders survey found only 10% of pre-retirees plan to hold out until 70.

The rest need the income earlier just to stay afloat.

Why Waiting Until Your Full Retirement Age Isn’t Always Possible

Your FRA lands between 66 and 67, depending on your birthday. And yes, filing at FRA means no penalty and the full benefit.

But a lot of Americans start claiming at 62, even though it reduces their monthly check.

Why? Because housing, food, and healthcare don’t wait — and neither do emergencies.

The ideal advice doesn’t always match the reality of a middle-class household.

The Hard Truth About Supplementing Social Security With Savings

Financial planners love to say Social Security shouldn’t be your only income stream.

In theory, they’re right. In practice, millions of Americans are already relying entirely on their monthly check.

About 39% of retirees live solely on Social Security.

And nearly two-thirds depend on it for more than half their income.

With everyday expenses climbing faster than wages, it’s no wonder people struggle to build the extra savings experts talk about.

Part-Time Work Sounds Good… Until You Try It

“Just work a little in retirement” is advice that often misses the mark.

Some older adults can and do take on part-time roles.

But many face health issues, mobility limits, caregiving responsibilities, or age discrimination when job hunting.

Even when a job is available, part-time wages may not make enough of a dent to truly help.

Frequently Asked Questions

Can I still claim early if my savings are low?

Yes. Many retirees file at 62 because they simply need the income. Just be aware your benefit is permanently reduced.

Is waiting even one year worth it?

Often, yes. If you can delay just 12 months, you’ll see a noticeable bump without needing to wait until 70.

Does working past retirement age affect my Social Security?

Once you reach FRA, your earnings no longer reduce your benefits — even if you keep earning good money.