KEY TAKEAWAYS

- Social Security’s 2026 COLA is officially set at 2.8%.

- Most retirees will see about $54 more per month.

- The raise helps, but rising Medicare costs may offset part of it.

Social Security COLA 2026 to Increase by $1,969: The Social Security Administration has confirmed a 2.8% COLA for 2026, and it’s about to give millions of Americans a little extra breathing room.

It’s not huge, but in a year where prices felt sticky and budgets stayed tight, every bump counts.

The average retiree currently getting $1,915 per month will see about $54 more, adding up to roughly $648 over the year.

2026 Social Security COLA Snapshot

| Category | 2025 Amount | 2026 Amount | Change |

|---|---|---|---|

| Average monthly benefit | $1,915 | ~$1,969 | +$54 |

| Max monthly benefit at FRA | ~$3,900 | ~$4,009 | +$109 |

| Payroll tax income cap | $176,100 | ~$184,500 | +$8,400 |

| Max annual payroll tax (worker share) | $10,917 | ~$11,439 | +$522 |

| Earnings limit for early claimers | $22,320 | $23,400 | +$1,080 |

What the 2.8% Raise Means for Your Wallet

Most retirees will see a modest bump, but the size of the increase depends on your current benefit.

Higher earners get a bigger dollar amount, but the percentage stays the same.

SSI recipients will get their increase a bit earlier—Dec. 31, 2025—since SSI pays on a different schedule.

Why the COLA Went Up — and Why It Still Feels Small

The COLA is tied to the CPI-W, which tracks inflation among certain workers.

When inflation rises, benefits follow. Simple enough.

But here’s the catch: retirees often face faster-rising costs than the CPI-W reflects.

Healthcare, prescriptions, insurance, and housing have eaten bigger chunks of household budgets.

So even a 2.8% bump may not feel like it’s keeping pace with real life.

Other Social Security Changes You’ll See in 2026

A few numbers are shifting behind the scenes, and they matter:

- Higher payroll tax cap: Income up to $184,500 will be taxed.

- Bigger maximum tax payment: Workers may pay up to $11,439 next year.

- Earnings limit increase: If you claim early, you can earn $23,400 before benefits are withheld.

How to Check Your New Benefit Amount

Your updated benefit will show up in your my Social Security account by December.

Paper notices will arrive by mail, too.

Make sure your personal info is correct and review how Medicare Part B premiums might shrink part of your raise. Early projections suggest another premium increase in 2026.

Smart Ways to Use Your COLA Bump

A small raise can still help you get ahead if you use it intentionally.

Redirect it to savings.

Automate a deposit into a high-yield savings account where your cash actually earns something.

Update your budget.

Treat the boost as a moment to reset spending—especially if groceries, utilities, or insurance costs have crept up.

Check your tax picture.

Higher benefits may increase your taxable Social Security income. A quick talk with a tax pro can save headaches later.

If you’re still building your retirement nest egg, the COLA is a reminder of the value of inflation-protected income—a feature many people overlook.

Frequently Asked Questions

How do I know exactly how much my 2026 Social Security payment will be?

Your updated amount will show in your my Social Security dashboard in December. The SSA also mails paper notices.

Will Medicare Part B eat up part of my COLA?

Possibly. Medicare premiums are expected to rise again for 2026. The official numbers will be released later this year.

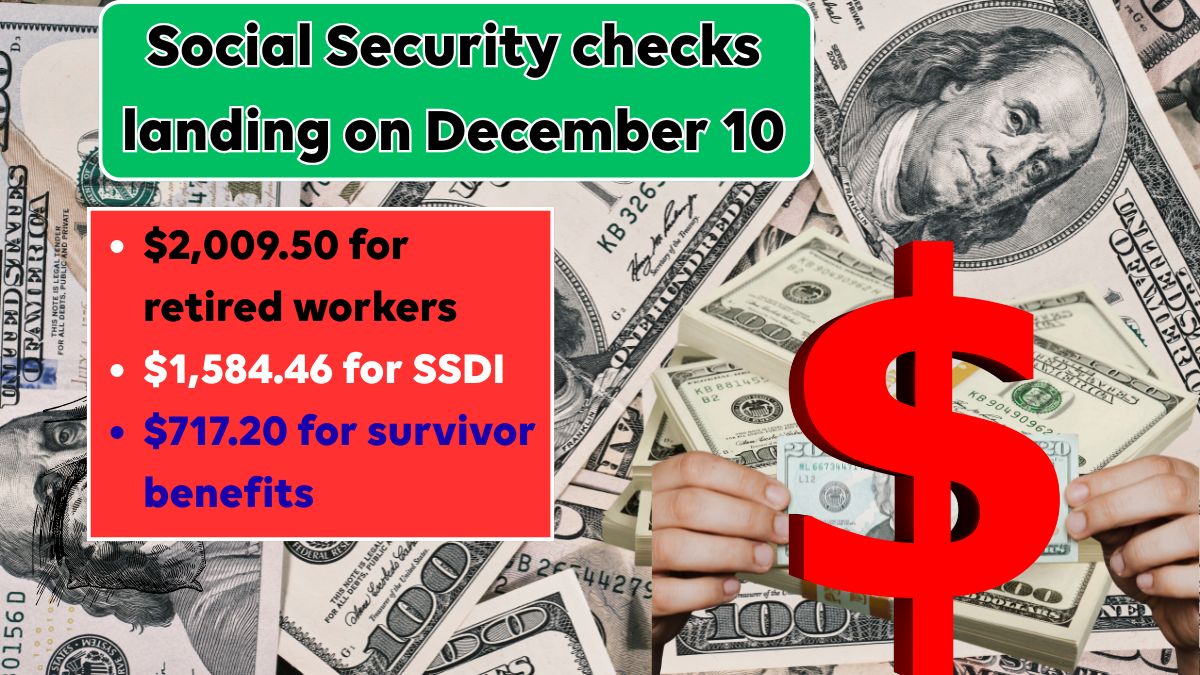

Does the 2.8% COLA apply to disability benefits too?

Yes. SSDI and SSI recipients receive the same COLA percentage, though SSI payments reflect the increase one month earlier.