KEY HIGHLIGHTS

- HDB households will get 1.5 to 3.5 months of S&CC rebates in FY2025.

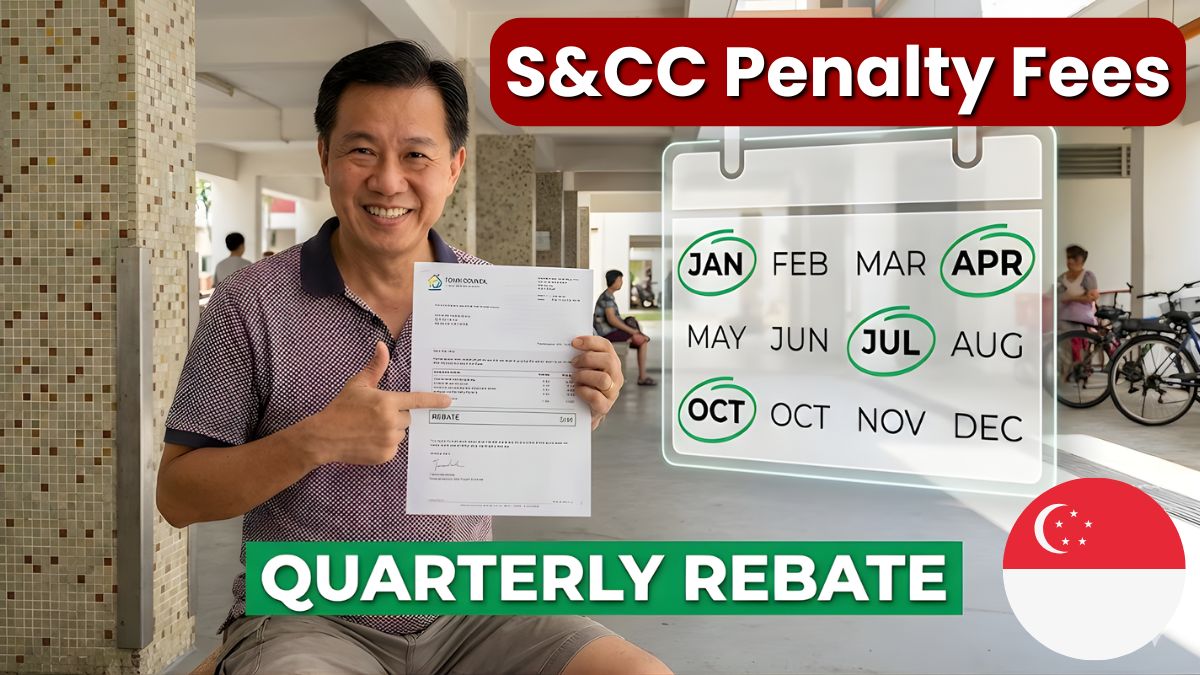

- Rebates arrive quarterly in January, April, July, and October with no application needed.

- The support helps families manage rising S&CC costs across towns from Jurong to Pasir Ris.

Quarterly S&CC rebates are back for FY2025, and they’re meant to ease the load for HDB households feeling the pinch from rising conservancy fees.

If you’re staying in a town council estate—from Jurong West to Nanyang or Taman Jurong—this support can help shave off a good part of your monthly bills.

The government will cover 1.5 to 3.5 months of your Service & Conservancy Charges (S&CC) through the GST Voucher – S&CC Rebate.

Summary Table: S&CC Rebate at a Glance

| Detail | Information |

|---|---|

| Rebate Amount | 1.5 to 3.5 months of S&CC |

| Payout Months | January, April, July, October |

| Who Qualifies | HDB households with at least 1 Singapore Citizen, no private property ownership |

| Application Needed? | No |

| Purpose | Offset monthly S&CC fees |

What the Quarterly S&CC Rebate Means for You

Think of this rebate as a quiet but helpful cushion.

Every quarter, you’ll see a smaller bill from your Town Council—Uncle and Auntie staying in 1-room or even DBSS flats will feel the relief most.

These rebates are part of Singapore’s ongoing cost-of-living support, especially for households who depend on their monthly GST Vouchers and utility savings to stretch their budgets.

When Will You Receive the S&CC Rebate?

Rebates will be applied automatically to your Town Council account in:

Service & Conservancy Charges (S&CC) Rebate 2025-26 Dates

No need to log into Singpass or fill forms.

Just make sure your outstanding bills are up to date so the rebate applies smoothly.

Eligibility: Who Can Receive the S&CC Rebate?

A HDB household qualifies if:

- There’s at least one Singapore Citizen owner or essential occupier.

- The owners/occupiers do not own private property.

- The flat is not rented out fully.

If your home is under these conditions, the rebate will appear automatically in your account.

S&CC Rates and Penalty Fees for FY2025

Different estates under Jurong West Town Council have different reduced and normal S&CC rates.

Here’s the clearer, reader-friendly breakdown for everyday households.

1-Room Flats

| Area | Reduced S&CC | Normal S&CC |

|---|---|---|

| Ayer Rajah, Boon Lay, Gek Poh, Nanyang, West Coast & Pioneer | $23.10 | $60.20 |

| Jurong Spring & Taman Jurong | $21.50 | $67.00 |

2-Room Flats

| Area | Reduced S&CC | Normal S&CC |

|---|---|---|

| Ayer Rajah…Pioneer | $33.00 | $61.90 |

| Jurong Spring & Taman Jurong | $32.50 | $73.50 |

3-Room Flats

| Area | Reduced S&CC | Normal S&CC |

|---|---|---|

| Ayer Rajah…Pioneer | $51.60 | $71.20 |

| Jurong Spring & Taman Jurong | $53.50 | $83.00 |

DBSS 3-Room (Jurong Spring / Taman Jurong)

Reduced: $75.00 | Normal: $96.50

4-Room Flats

| Area | Reduced S&CC | Normal S&CC |

|---|---|---|

| Ayer Rajah…Pioneer | $70.60 | $80.70 |

| Jurong Spring & Taman Jurong | $71.00 | $89.50 |

DBSS 4-Room (Jurong Spring / Taman Jurong)

Reduced: $92.00 | Normal: $110.50

5-Room Flats

| Type | Reduced S&CC | Normal S&CC |

|---|---|---|

| 5-Room (3 Gen), Ayer Rajah…Pioneer | $95.20 | $102.10 |

| 5-Room DBSS (Jurong Spring / Taman Jurong) | $111.00 | $125.50 |

Executive Flats

| Area | Reduced S&CC | Normal S&CC |

|---|---|---|

| Ayer Rajah…Pioneer | – | $115.20 |

| Jurong Spring & Taman Jurong | – | $116.00 |

Penalty Fees

Across all units and commercial shops, late payment penalty is $15 per month.

If you run a small shop, hawker stall, or kiosk, your S&CC is calculated by psm (per square metre) plus a basic flat-type charge.

This affects cooked food sellers, fresh produce stalls, mama shops, and kiosk operators.

Normal S&CC Rates Apply When…

The normal (higher) rate is charged if:

- No owner/tenant/occupier is a Singapore Citizen

- Any owner/occupier owns any private residential, commercial, or industrial property

- The flat is owned/leased by a company or body corporate

- The flat is vacant

All S&CC is inclusive of GST.

We’ve put all the key Singapore government payouts for 2025–2026 on one page – GST Voucher, Assurance Package, Silver Support, and SG60 Vouchers.

Check payouts & eligibility overviewHow Much Rebate Will You Get?

Eligible households will receive 1.5 to 3.5 months worth of rebates in FY2025.

This depends on your flat type and household circumstances.

For many families—especially seniors or single parents—this rebate helps keep monthly expenses under control.

FAQs

1. Do I need to apply for the GSTV – S&CC rebate?

No. It will be credited straight to your Town Council account.

2. How do I check if the rebate is applied correctly?

Log in to your Town Council portal or check your monthly statement.

3. Does owning a car affect eligibility?

No. Only private property ownership affects eligibility.

4. I’m renting out one room. Am I still eligible?

Yes, as long as you’re not renting out the entire flat.

5. Will the rebate reduce my S&CC for the whole year?

It lowers your bill for four months of the year.

6. Is this the same as CDC Vouchers?

No. This is part of the GST Voucher scheme, not the CDC Vouchers programme.