Most people want one simple thing from their savings — safety and steady growth. And here’s the thing: the Post Office Time Deposit (TD) scheme quietly delivers both. A lot of folks don’t even realise how powerful this scheme can be, especially compared to many bank FDs that keep dropping rates anytime the market shakes a little.

But when you look closely, something interesting happens. A single deposit of ₹1,00,000 in the 5-year Post Office FD can grow into ₹1,44,995 — guaranteed. No drama, no surprises, no hidden conditions. Just steady returns backed by the Government of India.

Let’s break down how the Post Office TD works and why so many people trust it to protect their hard-earned money.

How the Post Office TD Scheme Actually Works

Think of the Post Office Time Deposit as a fixed deposit with extra stability. While banks shift rates often, the Post Office keeps things predictable. You choose how long you want to keep your money — 1, 2, 3 or 5 years — and your interest rate stays locked for the entire period.

Here’s why people choose it:

- Guaranteed returns backed by the central government

- Higher interest than many bank FDs

- Simple rules and easy account opening

- Minimum deposit starts at just ₹1000

- You can open it alone or with up to 2 more people in a joint account

Now, why does it matter? Because in uncertain financial times, predictable growth is rare. And this scheme gives you exactly that.

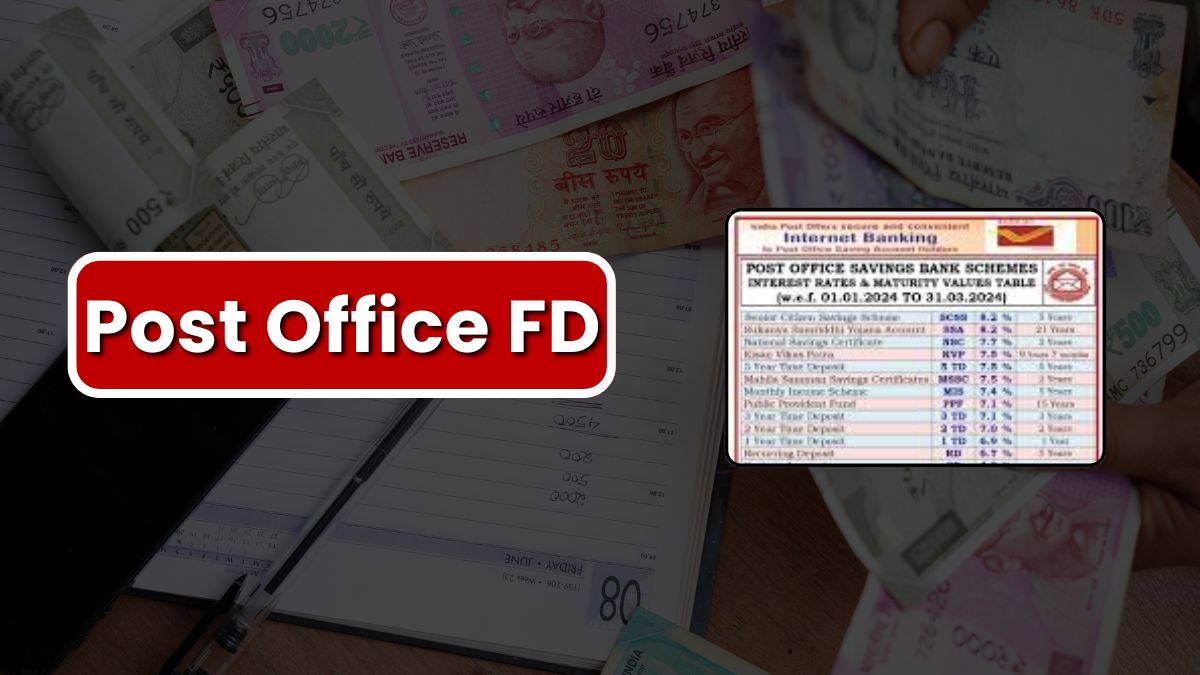

Current Post Office FD Interest Rates

Here’s a clear view of the Post Office TD interest rates across different tenures:

Post Office Time Deposit (TD) Interest Rates

| Tenure | Interest Rate | What It Means |

|---|---|---|

| 1 Year | 6.9% | Short-term growth with steady returns |

| 2 Years | 7.0% | Slightly higher, ideal for medium-term needs |

| 3 Years | 7.1% | Better rate for those who want stability |

| 5 Years | 7.5% | Highest return + tax benefit under Section 80C |

These numbers already beat many private and public-sector bank FDs — and that’s one reason this scheme is gaining fresh attention.

How ₹1,00,000 Becomes ₹1,44,995

Here’s the part most people want to know: how much money can you actually make?

If you deposit ₹1,00,000 for 5 years at 7.5%, your maturity value becomes:

- Total Maturity Amount: ₹1,44,995

- Total Interest Earned: ₹44,995

And yes, this return is guaranteed because the Post Office runs directly under the Government of India. You don’t have to worry about bank shutdowns, market conditions, or changing rates.

Honestly, for anyone who wants guaranteed growth without taking risks, this is one of the safest parking spots for their savings.

Why Many Investors Trust Post Office FD Over Bank FD

Here’s what I’ve noticed: banks usually offer better rates only to senior citizens, and that too on selected tenures. Regular customers don’t get those benefits. But the Post Office treats everyone equally — same interest rate for all.

Plus, the reliability factor matters. Your maturity amount is backed by the government. That peace of mind alone is worth something.

Final Thoughts Before You Invest

If your financial goal is stability, guaranteed returns and zero risk, the Post Office TD is worth considering. Just remember — lock-in matters. Choose a tenure that matches your needs so you don’t break the FD early.

And as always, it’s smart to talk to a financial advisor if you’re unsure about your long-term plans.

Frequently Asked Questions

1. Can I withdraw a Post Office FD before maturity?

Yes, you can, but only after completing six months. The interest will be lower if you exit early, so it’s better to choose a tenure you’re sure about.

2. Do Post Office FDs offer tax benefits?

Only the 5-year Post Office FD qualifies for tax deduction under Section 80C. Other tenures don’t offer tax benefits.

3. Is the Post Office FD safer than bank FDs?

Post Office TDs come with a government guarantee, which gives them a stronger safety cushion than many bank FDs protected only up to ₹5 lakh under DICGC coverage.