KEY HIGHLIGHTS

- Medicare Part B premiums will jump sharply in 2026.

- Standard premium rises to $202.90, plus a higher deductible.

- Social Security raises may feel smaller after these cuts.

IRMAA charges 2026: If you’re depending on Medicare to keep your medical bills under control, 2026 might pinch your pocket a bit more.

The new premium rates are noticeably higher, and for many retirees, that means tighter monthly budgets.

Most people wait till 65 to get on Medicare because private health insurance without employer support can be painfully expensive. But even after joining Medicare, not everything is free.

What’s changing in Medicare USA 2026?

The standard Medicare Part B premium will rise from $185 to $202.90 — that’s $17.90 extra every month.

And this isn’t the only cost going up.

Before we go deeper, here’s a quick breakdown.

2026 Medicare Cost Changes (Summary Table)

| Feature | 2025 Amount | 2026 Amount | Difference |

|---|---|---|---|

| Part B Premium | $185 | $202.90 | +$17.90 |

| Part B Deductible | $257 | $283 | +$26 |

| IRMAA Income Threshold (Single) | $103,000 | $109,000 | Higher limit |

| IRMAA Income Threshold (Joint) | $206,000 | $218,000 | Higher limit |

Higher earners will pay more

If your income crosses certain limits, you’ll face IRMAA (Income-Related Monthly Adjustment Amount) charges.

For 2026, IRMAA applies if:

- Single income: Above $109,000

- Married filing jointly: Above $218,000

These surcharges apply to Part B as well as Part D drug plan premiums. And since Part D premiums vary by plan, the total cost can be much higher for some seniors.

Deductible is rising too

The Part B deductible will jump from $257 to $283.

It’s a smaller number, but every dollar counts when you’re living on a fixed income.

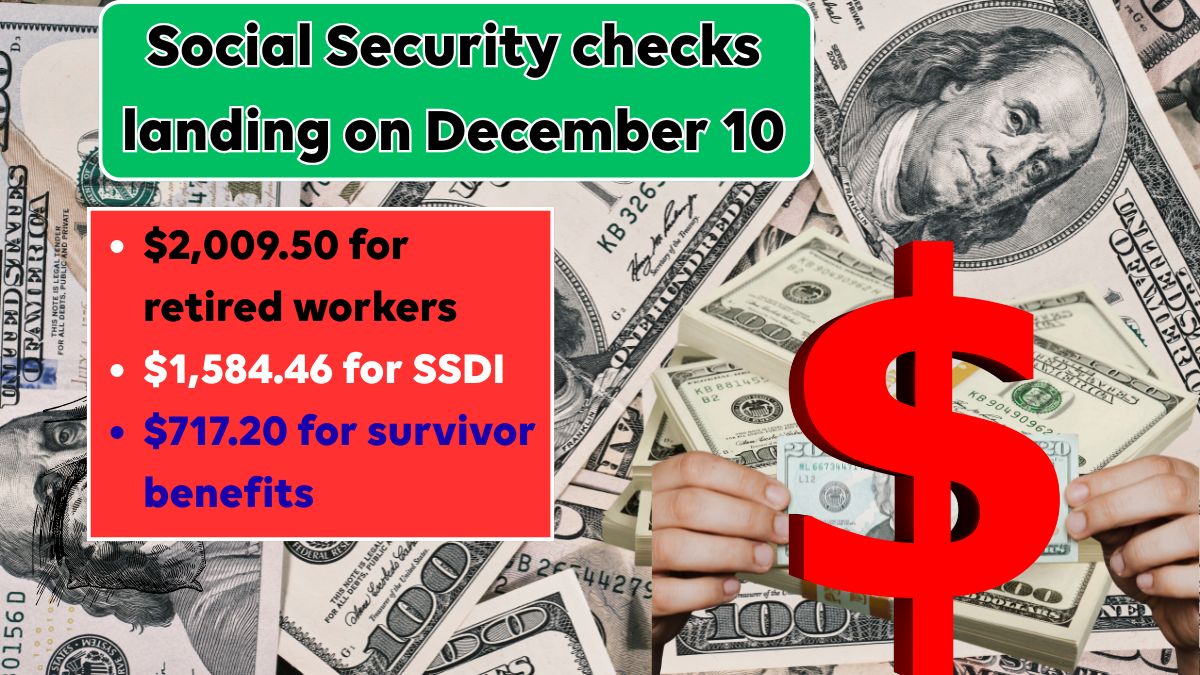

Social Security Raises Might Feel Smaller

Social Security benefits will get a 2.8% COLA in 2026, taking the average monthly benefit from $2,015 to about $2,071.

But most seniors have their Medicare Part B premiums deducted directly from their monthly Social Security.

So even though the raise is decent, the higher premium will quietly eat into it.

You’ll still see a net increase, but not as much as you might hope.

For seniors already stretching every rupee — or dollar — this is frustrating.

Part A Costs Are Rising Too

People often ignore Medicare Part A because most don’t pay a premium.

But the cost of hospital stays and skilled nursing facilities is going up in 2026.

So if you’re hospitalized or need post-care services, expect a slightly heavier bill.

Check Your Medicare Plan’s Notice

If you use a Medicare Advantage (MA) plan or a standalone Part D plan, your insurer might raise premiums too.

Every year, these plans issue an “Annual Notice of Change (ANOC)” — make sure you read it carefully.

These changes could affect your:

- Monthly premium

- Co-payments

- Drug coverage

- Network hospitals

Being caught off-guard is the last thing you want.

Now Is the Right Time to Plan

The smartest move? Start budgeting for 2026 right away.

A small monthly increase may look manageable now, but across the year, it adds up.

Knowing what’s coming helps you avoid surprises and manage your retirement income better.

Retirement planning is all about staying one step ahead — and 2026’s Medicare changes definitely need attention.

Frequently Asked Questions

Will Medicare Part B premiums definitely increase in 2026?

Yes, the standard premium is confirmed at $202.90, a significant rise from 2025.

Will my Social Security benefit go down?

Not down — but your take-home amount may feel smaller because higher Part B premiums are deducted automatically.

Do IRMAA surcharges affect my Part D premium too?

Yes. Higher earners pay extra for both Part B and Part D. The exact number depends on your income bracket.