KEY HIGHLIGHTS

- IRS urges Americans to start preparing for the 2026 tax season early.

- New deductions like no tax on tips, overtime and car loan interest.

- Paper refund checks ending — direct deposit becomes the default.

The IRS has dropped a nationwide alert, and the message is straight-up simple: don’t wait till the last minute.

Most people treat taxes like a once-a-year headache, but the agency wants everyone to start prepping before 2025 ends so refunds come faster and mistakes stay low.

Here’s the thing — with the new One, Big, Beautiful Bill shaking up deductions and credits, being early is the smartest move.

IRS 2026 Tax Rules Quick Comparison: What’s Changing for 2026?

| Feature / Rule | Earlier Years | 2026 Filing Season (New) |

|---|---|---|

| Filing season covers | 2024 income | 2025 income |

| Final filing date | 15 April 2025 | 15 April 2026 |

| Tax on tips | Taxable | No tax on tips |

| Tax on overtime | Taxable | No tax on overtime |

| Car loan interest | Not deductible | Becomes deductible |

| Senior benefits | Limited deductions | New temporary senior deduction |

| Refund method | Paper checks + direct deposit | Paper checks phased out |

| Refund speed (est.) | 3–6 weeks | Faster via direct deposit |

The IRS says, “It’s not too early to get ready.”

And honestly, they’re right — the new rules can affect how much you get back or how much you owe.

The filing season for 2026 covers earnings from January to December 2025, and with the updated rules, a bit of early planning can save stress later.

The agency is already updating systems to support fresh deductions like:

- No tax on tips

- No tax on overtime

- Car-loan interest deduction

- New temporary deduction for seniors

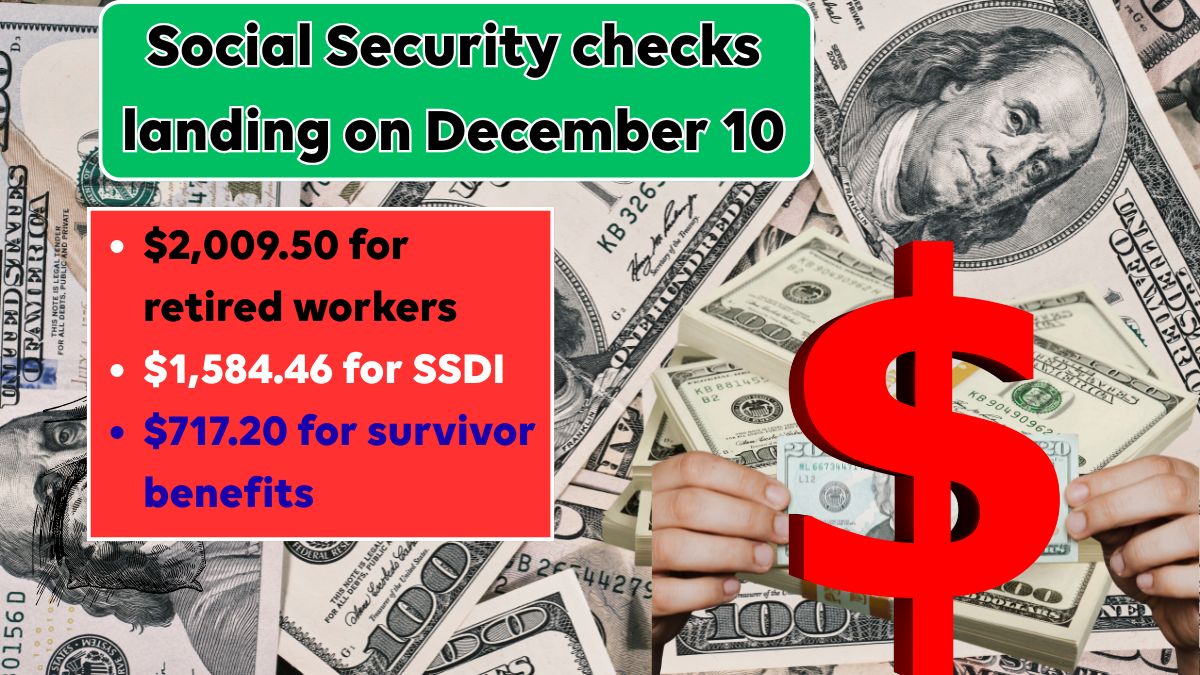

Plus, refunds are getting a makeover. From late 2025, the IRS will phase out paper checks, so almost everyone will receive money via direct deposit.

What You Should Do Right Now

A small checklist that can make tax season much smoother:

Create or log in to your IRS online account.

It’s the easiest way to view past returns, payments and transcripts.

Collect key documents early.

W-2s, 1099s, interest statements, investment records — anything that proves income or expenses.

Review life changes.

New job? Marriage? Baby? Home purchase? All these affect credits and deductions.

Set up or update direct deposit details.

Since paper checks are fading out, this step is crucial.

Plan to use e-filing or trusted professionals.

Faster processing. Fewer errors. Higher accuracy.

Keep receipts and records properly.

Charity donations, medical bills, education expenses, home improvements — anything that supports a claim.

Frequently Asked Questions

1. Why is the IRS asking people to prepare earlier than usual?

Because new rules in 2026 may affect deductions and credits. Preparing early reduces mistakes and speeds up refunds.

2. Will everyone be forced to use direct deposit?

Paper refund checks will be phased out by late 2025, so most taxpayers will receive refunds only through direct deposit.

3. Do the new “no tax on tips and overtime” rules apply to everyone?

Yes, these are part of the new tax legislation and will apply to eligible workers starting with the 2025 income year.