If you’ve ever wondered how much you’ll really get from your CPF every month, you’re not alone. A lot of people hit their 50s and suddenly realise they’ve spent years contributing… but have no idea what those numbers will look like as an actual monthly payout. And honestly, that uncertainty can be scary.

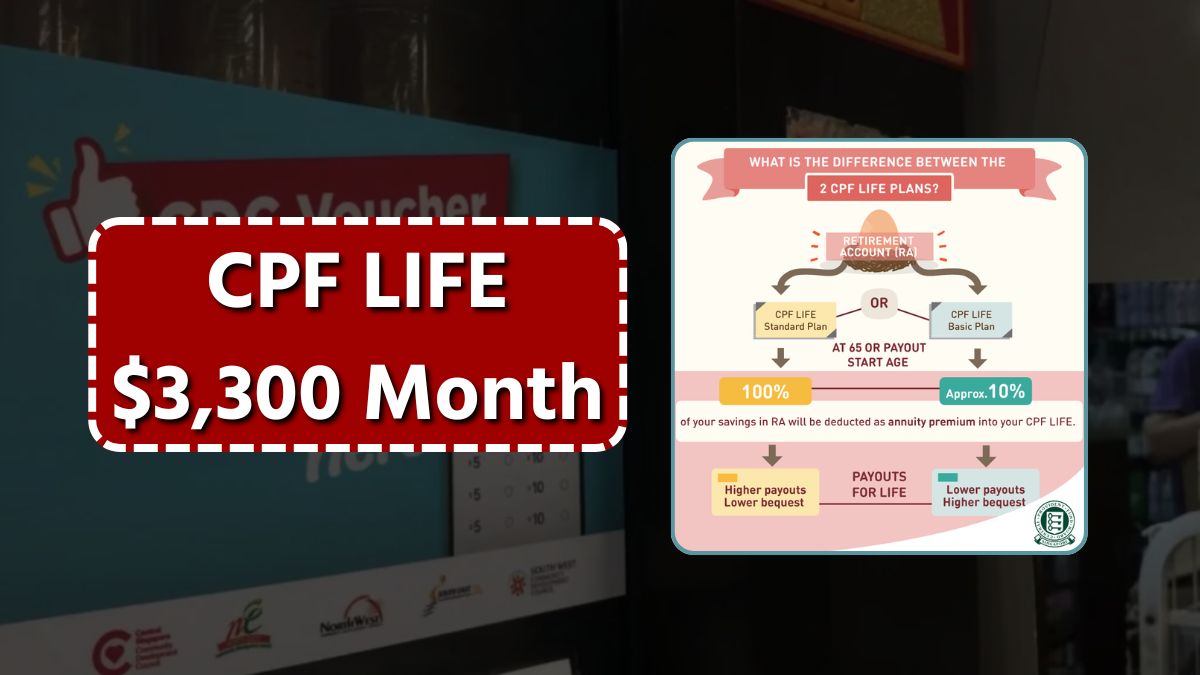

Here’s the thing—your CPF isn’t just a savings account sitting quietly in the background. It’s designed to grow with you, support your retirement, and give you monthly income for life under CPF LIFE. Knowing your potential payout early gives you room to plan, adjust, and breathe a little easier.

Let’s break it down in a clear, simple way so you can finally see what your retirement income could look like.

How CPF Monthly Payouts Really Work

Your CPF monthly payout mainly depends on two things:

- How much you’ve set aside in your Retirement Account (RA)

- The age you choose to start receiving payouts

Most Singaporeans begin payouts at 65, and under CPF LIFE, payouts continue for life. Someone with strong RA savings can receive up to $3,300 every month, which is more than what many expect.

If you want a quick estimate, CPF has a Retirement Payout Planner, but let’s use real numbers so you can see how the system works in practice.

Projected CPF Monthly Payouts Based on RA Savings

Think about it this way: your savings at 55 don’t just sit still—they compound for 10 years at up to 6% interest. That growth alone makes a huge difference.

Estimated CPF LIFE Standard Plan Payouts

| RA Savings at 55 | Estimated RA Savings at 65 | Estimated Monthly Payout at 65 |

|---|---|---|

| $50,000 | $82,400 | $490 |

| $106,500 (Basic Retirement Sum 2025) | $164,800 | $930 |

| $150,000 | $227,900 | $1,250 |

| $213,000 (Full Retirement Sum 2025) | $319,400 | $1,730 |

| $300,000 | $445,600 | $2,380 |

| $426,000 (Enhanced Retirement Sum) | $628,600 | $3,330 |

These numbers give you a feel for how much your retirement income can grow simply by hitting the right retirement sum.

Understanding the CPF System Without the Confusion

A lot of people get overwhelmed by all the different CPF accounts, so here’s the simplest way to think about them:

- Ordinary Account (OA): Housing + retirement

- Special Account (SA): Retirement

- MediSave Account (MA): Healthcare

- Retirement Account (RA): Formed at 55 for your payouts

And the interest? Better than what you get in most banks.

Members above 55 earn up to 6% on part of their savings. That’s why your RA amount can grow so much between 55 and 65.

CPF also supports lower-wage workers through Workfare and gives seniors MediSave top-ups, making the system more inclusive than many people realise.

When You Can Withdraw or Start Payouts

Here’s what catches many people off guard:

- At 55: You can withdraw up to $5,000, even if you haven’t met your Basic Retirement Sum

- At 65: You can withdraw up to 20% of your RA savings (minus that $5,000)

- Payouts always start at 65 for those born after 1953

The Basic Retirement Sum rises over time to match cost of living, which actually helps maintain your real spending power.

How Much More You Can Receive With ERS in 2025

If you top up to the Enhanced Retirement Sum (ERS), your payout can increase significantly.

Illustrative ERS Payouts (CPF LIFE Standard Plan)

- If you turn 55 in 2025 and top up to ERS instantly:

You may receive around $3,100–$3,300 monthly from age 65. - If you turn 65 in 2025 and top up then:

Your payout may be around $2,500–$2,700.

It’s simple—the earlier and higher your RA balance, the stronger your lifetime income.

Why All This Matters

Retirement isn’t just about numbers. It’s about peace of mind. When you know you’ve built a monthly income stream you can depend on for life, everything else feels lighter. Whether you’re planning to travel more, support your family, or just avoid money stress in your 70s—your CPF plays a huge role.

Frequently Asked Questions

1. What is the maximum CPF monthly payout I can receive?

Under CPF LIFE, the maximum payout is around $3,300 per month, depending on your Retirement Account savings and the plan you choose. Higher savings—especially reaching the Enhanced Retirement Sum—lead to higher lifelong payouts.

2. Can I withdraw more money from CPF before 65?

Yes. At age 55, you may withdraw up to $5,000 unconditionally. At 65, you can take up to 20% of your RA savings as a lump sum, but this will reduce your lifelong monthly payout.

3. Is topping up to the Enhanced Retirement Sum worth it?

If you want higher, stable lifelong income, topping up to ERS can make a noticeable difference. The earlier the top-up, the stronger the compounding effect, and the higher your eventual monthly payout.