Whenever the word “Pay Commission” makes headlines, government employees across India sit up and take notice. And this time, with the Eighth Pay Commission (8th CPC) being discussed actively, excitement — and confusion — are both in the air.

The big question many are asking is simple yet important:

Will this Pay Commission also raise the salaries of public sector bank employees?

It’s a fair question — after all, millions work in government banks, and every pay hike announcement sparks fresh hope. But the truth is a bit more nuanced. Let’s break it down clearly.

Who Actually Decides Bank Employees’ Salaries?

Here’s the thing — public sector bank employees aren’t directly covered under the Pay Commission.

Unlike central government employees, whose salaries are revised based on the Pay Commission’s recommendations, bank employees’ pay structures are decided separately.

Their salaries and pensions are determined through bipartite settlements — negotiations between the Indian Banks’ Association (IBA) and employee unions. In short, it’s a give-and-take process, not a direct government order.

Still, that doesn’t mean the Pay Commission has zero influence. Bank wage talks often refer to the government pay structure as a guide. So while there’s no automatic hike, there’s usually a ripple effect once government pay scales go up.

What’s Happening With the 8th Pay Commission Right Now

The 8th Pay Commission 2025, headed by former Supreme Court Justice Ranjana Prakash Desai, has already received its Terms of Reference (ToR) — which basically outlines what it will study and recommend.

If everything goes as expected, the new pay scales could take effect from January 2026. Around 5 million central government employees stand to benefit once the recommendations are approved.

The Role of the Fitment Factor

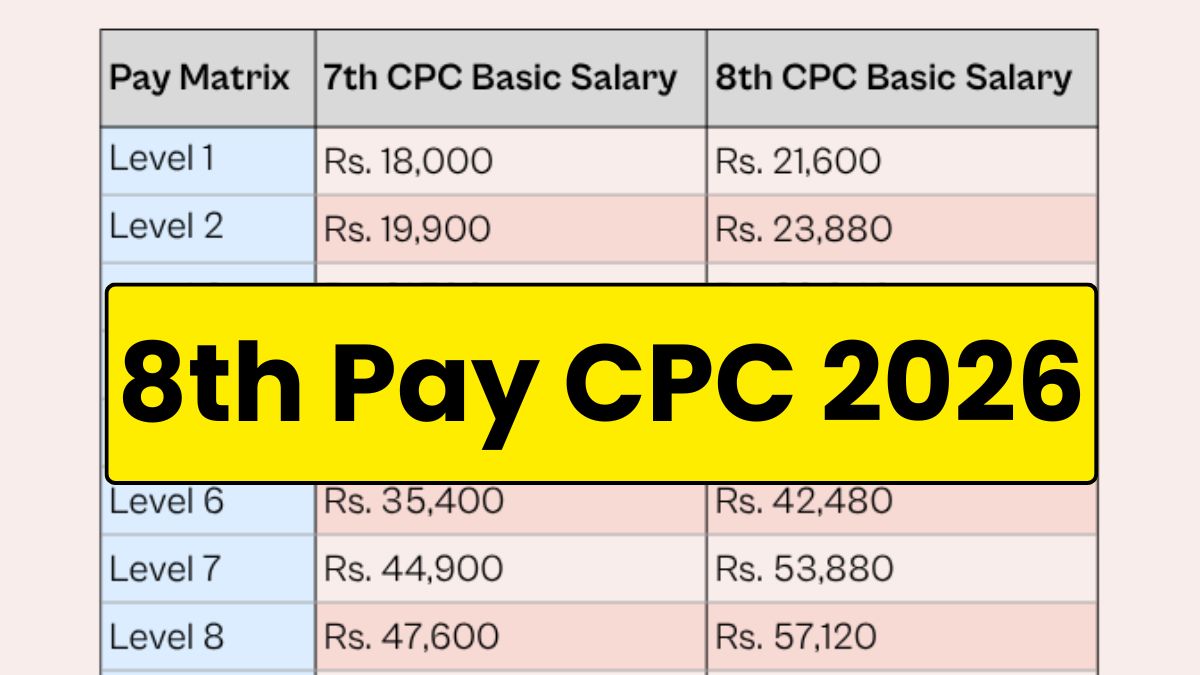

One technical but crucial term in every Pay Commission report is the fitment factor — it decides how much the basic salary will rise.

In the 7th Pay Commission, this factor was 2.57, while in the 8th Pay Commission, it’s expected to increase to around 2.86.

That could mean a significant jump. For instance, an employee currently earning a basic salary of ₹25,000 might see it rise to roughly ₹71,500 under the new formula — a huge difference.

What About Bank Employees? Will Their Pay Increase Too?

Here’s the reality: not immediately.

Bank employees’ wage revisions come through their own negotiation cycle. The last such revision happened after extensive discussions between IBA and unions — and the next one will follow that path.

However, unions have been pushing for a common pay framework so that bank staff can also benefit automatically whenever the government revises pay scales. Whether that happens remains to be seen, but the demand is gaining traction.

So yes, while central government employees may see a pay bump in 2026, bank employees might need to wait a little longer — unless a policy change bridges that gap in the future.

Frequently Asked Questions

1. Are bank employees covered under the 8th Pay Commission?

No. Bank employees’ pay is decided through bipartite settlements between the Indian Banks’ Association and unions, not by the Pay Commission.

2. When will the 8th Pay Commission be implemented?

It’s expected to be implemented from January 2026, after the commission submits its report and the government approves it.

3. What is the expected fitment factor in the 8th Pay Commission?

Experts believe it could rise from 2.57 (in the 7th CPC) to about 2.86, leading to a 25–30% increase in basic pay.